| | |

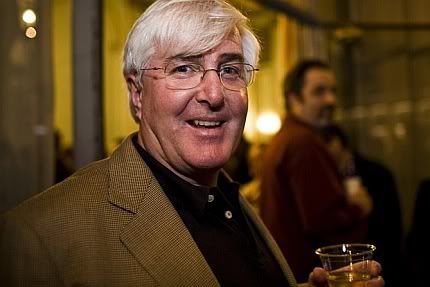

| October 8, 2008 Angel Investor Ron Conway Emails His Portfolio Companies Over Financial Meltdown. by Michael Arrington Ron Conway, one of Silicon Valley's most prolific angel investors (and he was also an early investor in Google), wrote an email yesterday to the CEOs of his portfolio companies. In no uncertain terms he outlines a bleak immediate future, and gives advice to his startups. It's the same advice, actually, that he gave in 2000 during the tech meltdown that was then happening in real time. Lower your burn rates to get at least 3 more months out of your current money, and raise money right now if you can. It's very similar to what Sequoia (and other VCs, I'm sure) are telling their startups. One thing Ron made clear in a conversation with me today. He's not worried about the state of innovation in Silicon Valley, and he isn't going to stop investing. He's not pessimistic about the future of technology at all. What he is concerned with is protecting the portion of his portfolio companies who don't currently have a large cash position to weather a storm, and he's sharing his experience from the last downturn to help them through this one. The full text of Ron's email is below, along with similar emails he sent on April 17th 2000 and May 10th 2000. | |

| |

| Ron Conway is an angel investor in Silicon Valley. He has made over 20 investments in Web 2.0 companies. Ron Conway also runs Baseline Ventures, an early-stage seed capital… Learn More | |

——— Forwarded message ———- From: Ron Conway We have all been absorbed by the turmoil in the financial markets the past few weeks Unlike the turmoil of 2000 when the "action" was centered right here in Silicon Valley this time is it centered on Wall Street…..but it has rippled to the west coast quickly and we will not be "immune" to its drastic effects. I was an active investor in 2000 when the "bubble burst" and remember it vividly and want to give you the SAME EXACT advice I gave to my portfolio company CEOs back then. I have pasted in the emails I sent on April 17th 2000 and May 10th 2000 and every word applies today. Unfortunately history DOES repeat itself but I hope we can learn from history and prevent the turmoil from occurring again. The message is simple. Raising capital will be much more difficult now. You should lower your "burn rate" to raise at least 3-6 months or more of funding via cost reductions, even if it means staff reductions and reduced marketing and G&A expenses. This is the equivalent to "raising an internal round" through cost reductions to buy you more time until you need to raise money again; hopefully when fund raising is more feasible. Letting go of staff is hard and often gut wrenching. A re-evaluation of timelines and re-focus on milestones with the eye of doing more with less will allow you to live many more days, and the name of the game in this environment in some respects is survival–survival until conditions change. If you are in a funding cycle, you should raise your funding as soon as possible and raise as much as possible but face the fact that if you can't raise money now you must cut costs. While I do not own a large percentage of your company I hope you will consider this thoughtful advice. I was here in 2000 and want to share what I learned through many years of experience and historical "pattern recognition"! Here are the two emails from the year 2000 that I referred to above and all the statements apply in today's market: —————————————————————————-—————————————- To: Angel Investors, L.P. Portfolio CEOs The down draft in the stock market sends us some obvious "signals" and we can't help but mention them. —————————————————————————-—————————————- To: Angel Investors, L.P. Portfolio CEOs I want to "touch base" again; given the continued uncertainty in the capital markets. As the market turmoil continues, we must underscore the advice that we have provided since mid April and it boils down to just a few points: We are still developing many new funding sources for our portfolio companies that are in funding cycle. | |

| © 2008 TechCrunch All rights reserved. |

viernes, octubre 10, 2008

El Inversionista Angel #1 aconseja a sus gerentes, como afrontar la crisis financiera actual.

Suscribirse a:

Comentarios de la entrada (Atom)

No hay comentarios.:

Publicar un comentario